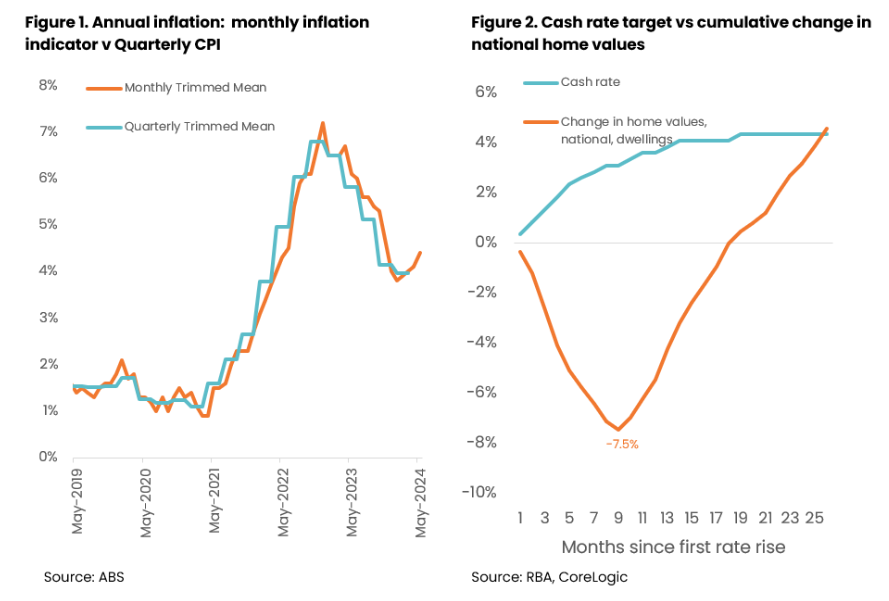

After last week’s Consumer Price Index (CPI) report showed a 4.4% inflation rate for May 2024, Corelogic explored whether this could lead to another RBA cash rate hike and further impact the housing and financial markets.

The monthly CPI indicator showed that inflation rose in the year leading up to May, with the ‘trimmed mean’ annual inflation rate increasing to 4.4%, up from 4.1% in April. Although the monthly CPI isn’t as comprehensive as the quarterly report, there are concerns that inflation is climbing again, which could require the RBA to raise the cash rate at it’s August Meeting.

Image source: Corelogic

Let’s explore 5 unexpected benefits to another rate rise in Australia.

1. Increased Savings Rate

As the cash rate rises due to rising inflation, Australian’s stand to benefit significantly. A higher cash rate also means interest rates are higher on savings accounts. This leads to better returns on savings and term deposits, offering savers a better opportunity to increase their savings.

This financial environment encourages individuals to save more actively, empowering stronger financial security and long-term wealth accumulation. Therefore, the increased cash rate provides an opportunity for financial planning and savings.

2. Potential Easing in Housing Demand

An increase in the Reserve Bank of Australia’s (RBA) cash rate can potentially moderate housing demand. In the past, low interest rates have led to rapid property value increases due to high demand, raising concerns about speculative bubbles.

A controlled rise in the cash rate can address this issue by curbing these unsustainable price increases, promoting a more balanced and stable housing market. Although this measure may have other side effects, such as further limiting borrowing capacities, it could help ensure that housing remains affordable and accessible to a broader population.

3. Enhanced Financial Discipline

An increase in interest rate can also lead to more responsible borrowing. As cash rates rise, which means interest rates for borrowing rises, individuals are encouraged be more careful in their financial planning and savings.

This shift towards greater financial responsibility leads to prospective buyers who may adjust their purchasing decisions based on affordability and long-term financial sustainability.

In the long run, higher interest rates contribute to a more resilient and balanced economy, fostering sustainable growth in the housing market and broader financial sectors.

4. Improved Rental Market Conditions

Higher interest rates can potentially improve the rental market by shifting preferences towards renting. As mortgage costs increase, domestic demand may decrease due to prospective homebuyers finding it more financially prudent to delay purchasing a property.

This can result in increased demand for rental properties, particularly in capital cities where affordability remains a challenge for many Australian people. Property Investors will highly benefit from this, and may also benefit from stable or rising rental yields, as domestic demand for rental accommodation is higher.

5. Stabilised Economic Growth

Interest rates play a pivotal role in stabilising economic growth. By adjusting rates, the Reserve Bank of Australia aims to manage inflation and support sustainable economic expansion. Higher interest rates can help cool down overheated sectors like housing and consumer spending, preventing bubbles and ensuring steady growth.

Additionally, a controlled rate environment promotes prudent financial behavior among businesses and consumers, encouraging long-term investment and enhancing financial stability. This balanced approach supports economic resilience, enabling Australia to navigate global economic challenges while maintaining robust growth across diverse sectors.

Read More: Australian Homeowners Gain $59K Wealth Boost

Conclusion

As Australia navigates through economic adjustments marked by rising inflation, the prospect of higher interest rates brings unexpected benefits for the Housing and Financial Markets.

Embracing these changes therefore ensures a resilient housing sector that not only withstands current challenges but also thrives in a balanced economic landscape.