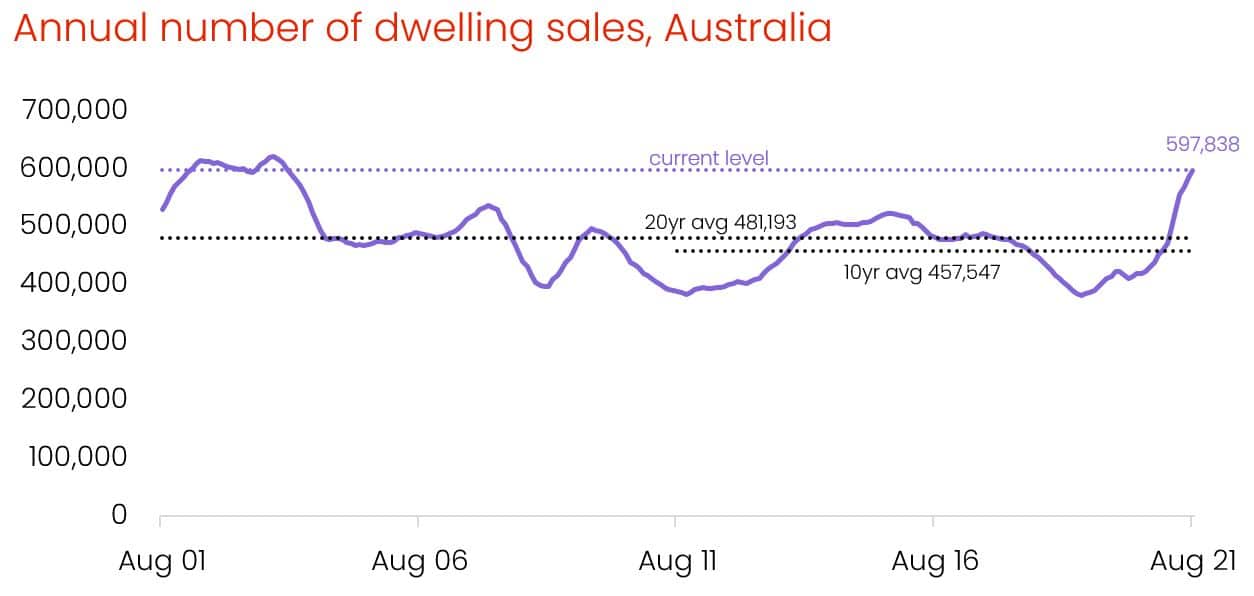

This year’s home sales have reached the highest level since 2004, as a result of record-low mortgage rates, loosening credit policies, stamp duty concessions, and record COVID-19 savings.

Properties sold this year

According to CoreLogic, about 598,000 houses and units were sold in Australia in the year by August 2021, the greatest annual number of sales since 2004 and a 42% increase over the previous 12-month period. The number of house and unit sales last year was 31% more than the decade average and 24% higher than the 20-year average.

Source: Corelogic Report

“It’s a real story of extremes, with record-low levels of listings this year and record levels of domestic demand leading to a huge number of sales and the biggest price growth since 1989,” said CoreLogic research director Tim Lawless.

“But hopefully next year will be more balanced with more listings to satisfy demand, housing affordability problems, credit tightening and the exhaustion of buyer demand. Many people who wanted to buy will have already bought and we might see the tide finally turning, and the market that’s been so skewed to the seller seeing buyers getting a bit more of the power.”

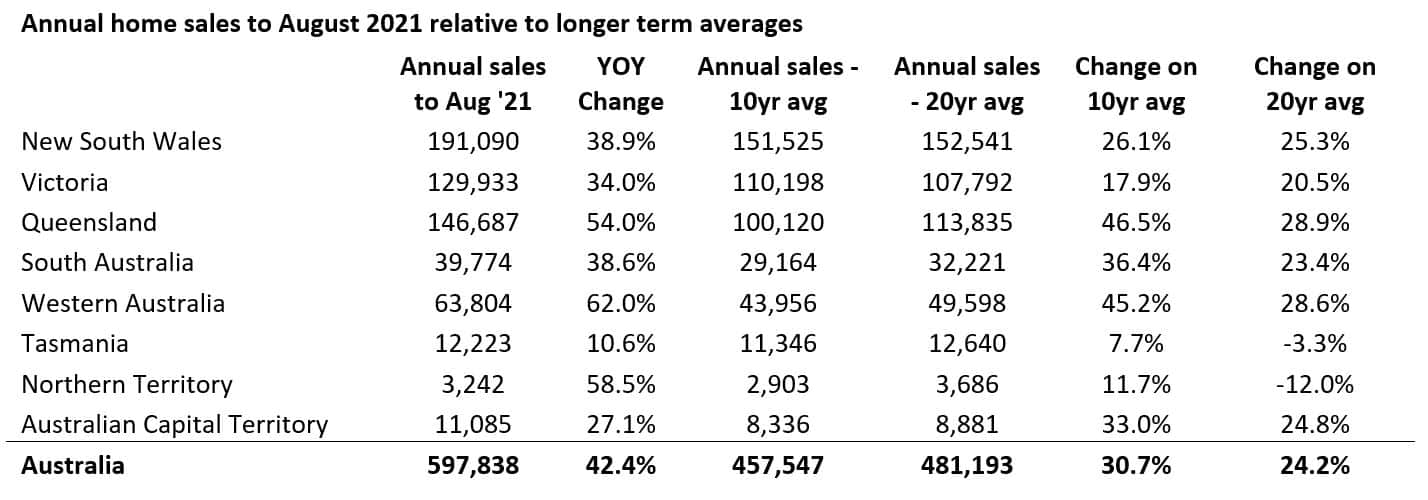

Annual Home Sales Comparison

The new research shows turnover annual home sales as a percentage of the total number of homes – has now hit 5.6%, the highest rate since December 2009.

Annual home sales are much higher across the states than they were a year ago, with every state and territory except Tasmania reporting a year-on-year increase of more than 10%. The largest annual sales are in New South Wales, indicating a strong property market with a healthy amount of housing turnover.

Source: Corelogic Report

Home sales increased 38.9% in NSW, 34% in Victoria, and 54% in Queensland compared to the previous year. The most significant surges were in Western Australia (62%), and the Northern Territory (58.5%), both locations where previously weaker markets have been catching up.

Housing Demand

While such a large increase in housing demand may appear surprising at a time when overseas migration has slowed, the big increase in home sales can be explained by a boost in local demand from previously low levels.

“That demand, however, will have to gradually taper off,” said Mr Lawless. “Already we’re seeing signs that a lot of people have bought homes and affordability issues are becoming increasingly compromising and banks are becoming more cautionary with buyers with smaller amounts of savings.”

Is credit easier or harder to get?

Just two years ago, housing turnover dropped to a record low of 3.7% as a result of tighter credit conditions, conditions tightened housing affordability and high transaction costs, such as stamp duty.

But now, to revive the coronavirus-hit economy, credit policies have been loosened and mortgage rates have dropped to new lows, attracting more Australians to enter the housing market and stimulating housing turnover.

How does Household Savings impact housing turnover?

Furthermore, since March 2020, a greater rate of household savings and household incomes has boosted consumer deposit levels and mortgage serviceability, while government incentives including stamp duty discounts and deposit guarantees have also encouraged demand.

Housing turnover will probably continue to increase in the short term as more spring listings come onto the market, with Mr Lawless saying he expected it to peak early next year.

Many state governments are looking to move away from property transaction disincentives, such as stamp duty, which would encourage increased turnover in the long run, according to Lawless.

“It’s encouraging to see state governments in the ACT, SA, and NSW moving away from stamp duty, albeit with different strategies and timelines, which should assist to eliminate barriers for homeowners and prospective buyers to transact in the housing market,” Lawless said.

According to Yahoo Finance’s experts, Australia’s housing market has been booming across capital cities and regional housing markets together with property demand soaring, a drop in prices is not likely. And as long as the Australian population is growing, especially when borders open and overseas migration returns to normal, so will the property market.

Now is an ideal time to purchase property! Contact Liviti on (02) 9056 4311 or enquire here and our team will guide you through the best options to purchase property during this time.