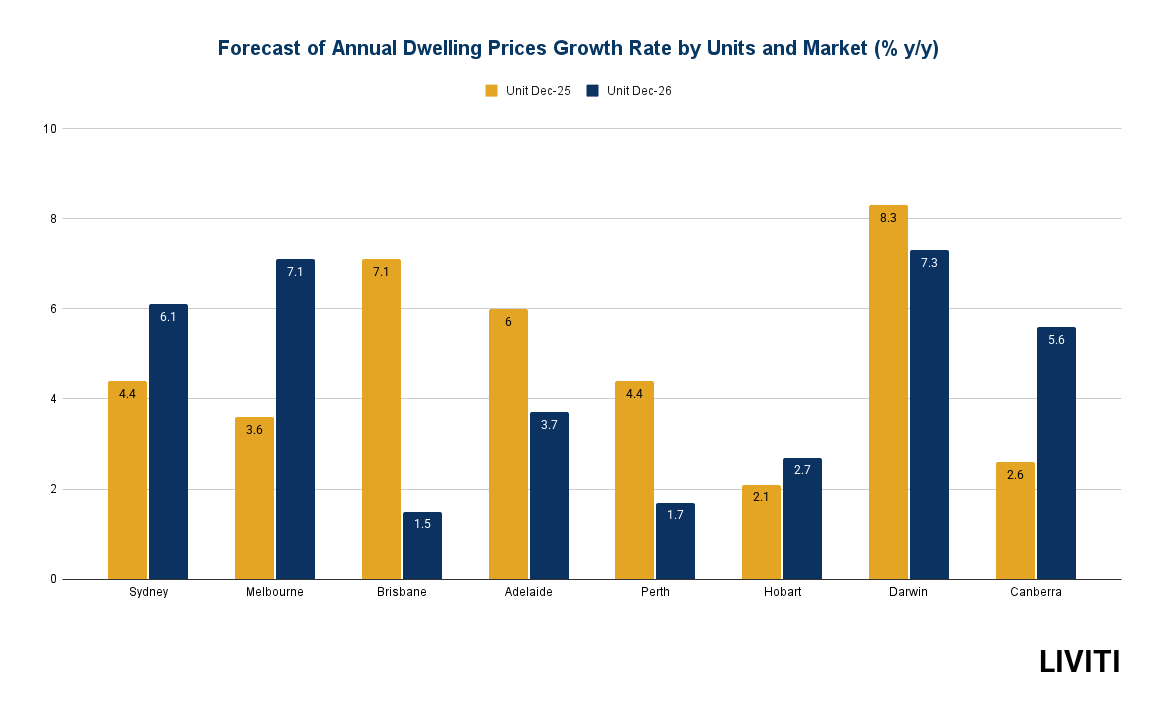

As the Australian property market landscape recovers and adapts to new economic realities, Melbourne emerges as a key player with strong growth prospects, particularly in its unit sector compared to the housing sector. According to KPMG’s August 2025 Residential Property Market Outlook, Melbourne is expected to experience notable unit price growth in the coming years, an impressive 7.1% by 2026.

This growth is fundamentally driven by a widening gap between housing supply and demand. Melbourne’s market is experiencing a significant uplift from renewed buyer and investor confidence, spurred by earlier-than-expected interest rate cuts. As a primary destination for overseas arrivals, the city’s solid population growth is placing continued pressure on housing availability.

Why Melbourne’s Units Are Set for Strong Growth

We’re seeing a decisive turnaround in the Melbourne property market in 2025, ending the prolonged downturn that began in 2022. Key growth drivers are now in place, including renewed buyer confidence and strong population growth, which are creating the ideal conditions for capital appreciation and robust rental demand.

Despite a challenging period marked by affordability issues and a slow recovery, the forecast for units is highly optimistic. Here are the key drivers:

1. Affordability Crisis Pushing Demand for Units

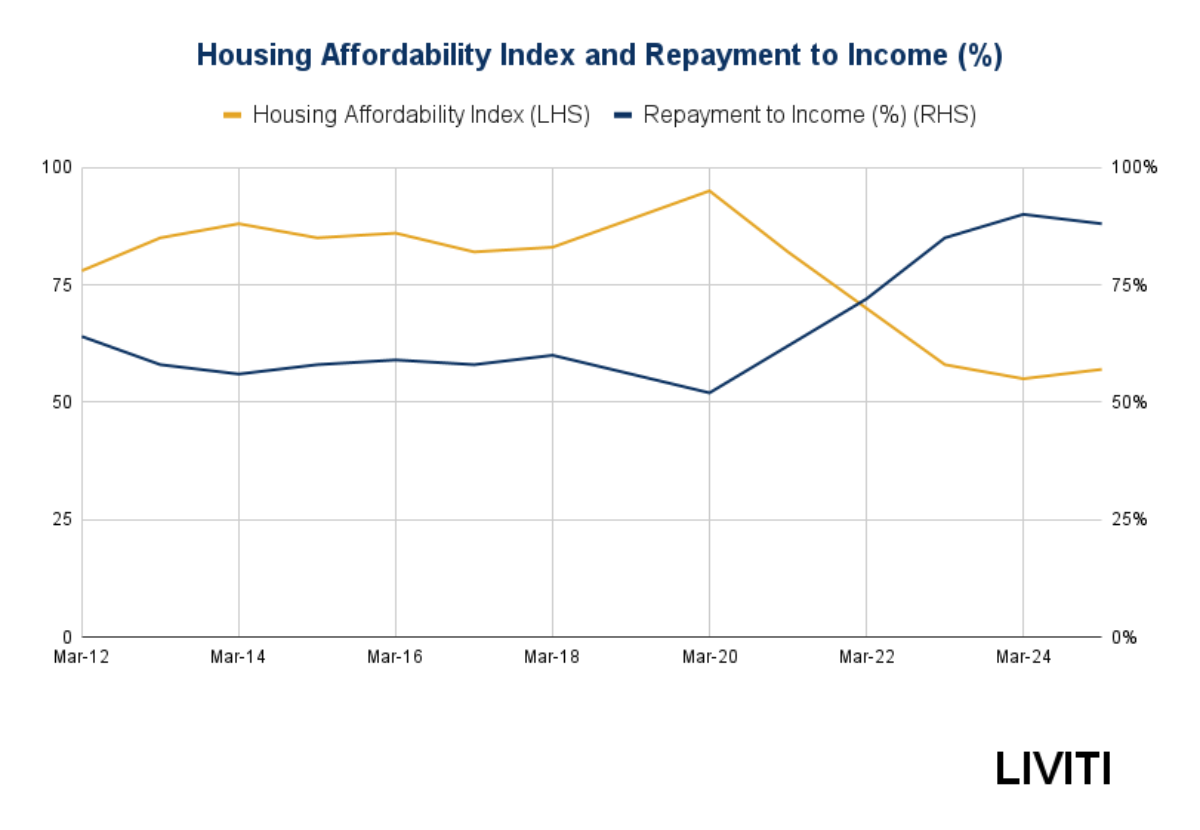

The key trend impacting Melbourne’s property market is affordability. As most of the home prices in Australia continue to rise faster than the average wages of people, many property buyers are being pushed out of the detached house market. This has fueled increased demand for more affordable housing options, primarily in the form of units and apartments.

August 2025’s published KPMG Residential Property Market Outlook report predicts that Sydney, Melbourne, and Canberra will have much stronger growth in 2026 compared to what they have in 2025. Property investment in Melbourne has become more expensive these days, but yet the recent RBA cash rate cut to 3.60% has opened enormous opportunities for property investment in Melbourne, and more property buyers havealready started to invest in property in Melbourne by buying units or apartments in Melbourne because of practically limited access to houses and land and their incurring buying and maintenance costs.

If being carefully analysed, over the years, property investors or first-home buyers who are directly affected by the RBA-announced rates have shown an inversely proportionate relationship between affordability and repayment to income. Over the years till the beginning of 2022, the investment property values were expensive, and limited people could barely afford them with the high interest rate. But after 2022, the Australian government has been trying their best to align the interest rate with favor to the people and thus the last RBA rate cut in August 2025 to 3.60% will provide more opportunity for affordability towards units and apartments in Melbourne and people are more likely to pay the repayments of loans because of the low interest rate with correlation to the affordability of units and apartments.

Unit prices in Melbourne are projected to grow by 3.6% in 2025, with a robust 7.1% increase in 2026, outpacing house prices. This shift is a response to the growing financial challenges many Australians face as they look for affordable entry points into the property market.

2. Rising Rental Demand and Slower Rent Growth

In Melbourne, the rental market is also seeing some interesting shifts. The KPMG report highlights that rental growth has slowed but remains strong. With the gap between renting and buying closing, many potential homebuyers are looking at owning a unit as an investment opportunity. This growing demand for rental properties supports the upward pressure on unit prices.

Although rent growth has moderated, it remains above long-term averages. This trend is expected to persist through 2026, creating a more sustainable rental market, especially for investors focusing on units.

Key Trends Shaping Melbourne’s Property Market

While the outlook for Melbourne’s units is promising, several underlying factors will continue to shape the market over the next few years. Here’s a closer look at these critical dynamics:

Lower Interest Rates and Improved Sentiment

The Australian property market, including Melbourne, has been buoyed by the Reserve Bank of Australia’s (RBA) interest rate cuts. This action, aimed at stimulating buyer sentiment, has already started to show results. In the first half of 2025, the RBA’s rate cuts led to a spike in buyer confidence, helping to stabilize the housing market.

For Melbourne, the effects are clear. As borrowing costs decrease, we expect even greater demand for property, especially in areas offering affordability and future growth potential.

Construction Costs and Supply Dynamics

The KPMG report also reveals that while construction costs have moderated, they are still a key component influencing property prices. Melbourne’s unit market has benefited from the easing of material costs, allowing developers to bring more supply to the market.

However, despite rising housing approvals, the market still faces a significant supply-demand imbalance. Melbourne, like many other cities, will continue to struggle with a shortfall of housing, pushing more demand towards available units. With supply expected to meet only 70% of the target needed, this imbalance could fuel further price growth, especially in urban areas.

We are currently running weekly webinar on the Melbourne Property Market to provide exclusive data driven insights and predictions of the property market so that you do not have to research and predict by your own.

For more in-depth insights into Melbourne’s property market and how you can capitalize on these opportunities, join us at our Liviti Weekly Property Showcase webinar. Register for the webinar now and get the data-backed advice you need to make confident investment decisions.

You cab also book a one-on-one consultation with one of our property investment experts to explore your investment options in greater detail.

What Does This Mean for Property Investors?

Investors looking to Melbourne for opportunities should keep the following factors in mind:

-

Shift Towards More Affordable Housing: As the price gap between houses and units narrows, units will become an increasingly attractive option for both first-time buyers and seasoned investors. With prices expected to rise steadily, Melbourne’s unit market offers promising returns.

-

Growing Rental Demand: With population growth in Melbourne outpacing dwelling completions, rental demand will remain high. Investors targeting rental properties will see steady returns, especially in well-located unit developments.

-

Strategic Timing for Property Purchases: Given the expected price growth, now is a great time for savvy investors to secure properties before prices increase further. As affordability continues to drive demand, investors will benefit from locking in properties while they are still relatively undervalued.

-

Long-Term Growth Potential: Melbourne’s property market is set for sustained growth, particularly in the unit sector. While short-term challenges may exist, the long-term prospects remain strong, with KPMG forecasting unit price increases through 2026.

Is Melbourne’s Property Market the Right Fit for You?

If you’re wondering whether Melbourne’s property market aligns with your investment goals, it’s important to take a long-term view. While current conditions might seem challenging, the combination of affordability issues, population growth, and improved market sentiment points to solid returns in the years to come.

For those interested in making informed property decisions, Liviti Property offers the expertise and insights you need. Our team specializes in providing data-backed recommendations, helping you navigate the complexities of Melbourne’s property market.

Frequently Asked Questions (FAQs) on Melbourne Property Market

-

Why are unit prices in Melbourne set to grow faster than house prices?

-

Affordability issues are driving more buyers toward units, as they offer a more affordable entry point into the market.

-

-

How do interest rate cuts impact the Melbourne property market?

-

Lower interest rates increase buyer confidence and borrowing capacity, leading to increased demand for properties, particularly units.

-

-

What is the forecast for Melbourne’s rental market?

-

Rent growth is expected to moderate but remain above the long-term average, supporting steady rental demand.

-

-

Should investors focus on units or houses in Melbourne?

-

Units are expected to outperform houses due to affordability issues, making them a more attractive investment option.

-

-

How is Melbourne’s housing supply affecting prices?

-

Despite increased housing approvals, Melbourne faces a shortfall in housing supply, particularly units, which supports price growth.

-

-

What role does population growth play in Melbourne’s property market?

-

Population growth increases demand for housing, especially in urban areas, putting pressure on both the rental and purchase markets.

-

-

What factors contribute to the affordability crisis in Melbourne?

-

Rising property prices and slower wage growth have made it difficult for many Australians to afford detached houses, leading to more demand for units.

-

-

How does the rental market influence property prices?

-

As rental demand grows, especially in urban areas, it drives up the prices of rental properties, including units.

-

-

Are there any risks associated with investing in Melbourne’s property market?

-

The primary risk is the affordability issue, which may limit buyer demand in the future. However, units remain a strong investment option due to relative affordability.

-

-

What can investors do to take advantage of Melbourne’s market conditions?

Investing in units, particularly in areas with strong rental demand and affordability, is likely to yield the best returns over the next few years.