For many, being able to buy a property in the Australian suburbs close to one of the major capital cities is “the dream”.

Unfortunately, this dream is quickly followed by the reality of a home loan, interest rates and monthly repayments of a mortgage.

Investors, however, see these properties as future income and assets, rather than liabilities. Savvy investors can very quickly reduce home loans by listing their investment property on the rental market and taking advantage of buying in areas that produce great cash flow and aiming to achieve the best rental yield possible.

An increase in cash flow and profit from a rental property is certainly possible by researching where there is rental demand, where the best rental yields can be found and by obtaining strong knowledge surrounding capital growth.

What is Rental Yield?

Rental yield is the profit an investor receives per year from a property, as a percentage of its purchase or current value.

Essentially, in simple terms, rental yield is a figure that can help a homeowner understand how well their property is performing in the current market by providing valuable information in a simple, easy-to-understand format.

The yield figure can be used to compare the investor’s properties with other properties in the area, as well as being valuable information when it comes time to make decisions.

Generally speaking, a higher rental yield means more potential for rental returns for investors from annual rental income.

There are two different types of rental yields that all investors should be aware of, whether they’re just entering the game or are seasoned veterans.

What Are the Two Types of Rental Yields?

There are two types of rental yields, these being gross rental yields and net rental yields. Both play an important role in helping investors make informed decisions regarding their investment portfolios.

Here’s what you need to know…

Gross Rental Yield

Firstly, let’s discuss gross rental yield.

This relates to the total annual income received from an investment property through rent, before tax.

After the annual rental income before tax is calculated, the gross rental yield is then transformed into a percentage of the property’s purchase cost or current market value.

Net Rental Yield

Now, the second type of rental yield is net rental yield, which is calculated by adding up the total income of a rental property, then taking away expenses or purchase transactions, for example, monthly fees or the charges local agents might tack on for marketing and property management.

As with gross rental yield, the net rental yield is produced as a percentage of the purchase price (or current property value) of the rental property.

How is Rental Yield Calculated?

We know we touched on this briefly in the section above, but here’s a bit more of an extended explanation as to how rental yield calculations should be carried out.

If you’d much prefer to skip over this part and just have someone like an Australian financial services licensee do the math for you, be our guest. Numbers can be super tedious sometimes, though it does often pay to learn about these things yourself. You do you, fam.

How to Calculate Gross Rental Yield

Calculating gross rental yield simply comes down to dividing annual rental income by the value of the property and multiplying that by 100 to get a valid percentage.

Here’s the gross rental yield calculation formula…

Gross rental yield = (annual rental income/property value) x100

And an example…

Let’s say a guy named Mike purchases a property for $800,000. Rental prices for the property have hit an all-time high of $600 per week (lucky Mike!).

As the property owner, in order to figure out the gross yield, Mike would need to multiply the weekly rent figure by 52 to find out the annual rental income ($31,200), then divide that figure by the property purchase value (0.039), then times that figure by 100 for a gross yield percentage of (drumroll, please)…

3.9%

Did you get that? Or have we lost you? Feel free to run your eyes over that one more time, we know it’s a lot to take in on the first read-through.

Now, moving on to our second calculation explanation…

How to Calculate Net Rental Yield

Calculating net yield utilises the same formula as gross yield, but it takes into account any expenses incurred throughout the year that relate to the property.

Here’s the net rental yield calculation formula…

Net rental yield = [(Annual rental income – annual expenses) / total property cost] x 100

And an example (Mike’s back)…

Now, Mike wants to know what the net yield of his rental property is sitting at.

First, he will need to calculate the total of his annual expenses incurred from this particular property investment. Let’s say he’s spent $3500 on things like insurance, repair costs, agent fees and mortgage repayments (among other expenses, but let’s keep it as simple as we can for now).

So, Mike is going to take the $3500 expense total and minus it from his annual rental income amount ($27,700), then he will divide that amount by the total property cost (0.035), and finally, multiply that figure by 100 for a net yield percentage of…

3.5%

We get that this stuff can be hard to wrap your head around if you’re a first-time investor, so please don’t hesitate to reach out to us directly and ask to speak with one of our super friendly (and highly experienced) property experts. They know exactly how you’re feeling…after all, we all have to start somewhere, right?

What is The Importance of Understanding Rental Yield?

Understanding rental yield can help investors gain a better understanding of cash flow, work on an investment strategy for the future, figure out whether they may be able to afford a particular home loan amount on a new property, consider their personal objectives and whether the property is working well for them and see how their home is standing in relation to the rest of the property market.

In short, understanding rental yield can help an investor determine both affordable property prices and those that may be out of reach, given their personal circumstances, among an array of other helpful tidbits.

What Other Factors Should Be Considered Alongside Rental Yield to Provide Property Insights?

Vacancy rates

The statistic used to determine the number of vacant properties on the market at one time is known as the vacancy rate. The vacancy rate is normally calculated as a percentage, by dividing the total number of properties currently for rent by the number of properties currently listed.

Knowing the vacancy rate in a particular area is a fantastic way to compare the viability of purchasing a property there and can assist greatly in working out the best rental yield suburbs for consideration.

Generally, the lower the vacancy rate, the better chance the suburb will produce high yield properties. Of course, this isn’t always the case and proper care should be taken to perform thorough research before purchasing a property.

Growth pattern trends and insights

Studying growth patterns and other trends can assist an investor in determining whether the median rental yield, interest rates and home loan options of a particular area, or the entire market, at any given time, is going to provide strong capital growth, best rental yields and other favourable outcomes.

By studying statistics like the median weekly rent and median sale prices, profitable locations can be ascertained; median rental yield can often be determined as an approximation by using these two figures (again, not always, but often).

It is important to note that one issue with using median rental yield to determine potential profit is that property prices in the area may have increased over time after the initial purchase, therefore the investor’s rental yield may end up lower than the median for the area.

Overall, it’s safe to say that studying the median prices in capital cities, regional areas and city suburbs, alongside other information and statistics can assist both current and future investors in successfully growing their property portfolios.

What is a Good Gross Rental Yield?

It is honestly quite hard to accurately define what a good gross rental yield is. If anyone tells you they know exactly what yield is the best for you (or the best in general)…tell them, in no uncertain terms, to cut the crap.

Sure, we can speculate. A lot of property experts will say that a rental yield of around 2-3% higher than the current variable mortgage rate is good, or a percentage of 5-6% higher is great. But that’s all it is…speculation.

The truth is that a good rental yield depends entirely on the circumstances of the buyer. Things like…

- Their current financial situation and whether they have a steady stream of income.

- Specifics of loans including loan term, loan amount, credit provider and other options available to them regarding home loans.

- What they define as affordable property prices.

- Their goals when it comes to entering the rental market as a property investor and where they want to take their portfolio.

- And a whole lot more!

The circumstances of the purchase come into play as well. For example, a property’s rental yield at present may be lower than average but the median property values of the area may be on the rise – which can help to increase the rental yield over time.

Suffice to say, there’s no blanket ‘best yield figure’. It’s all a matter of circumstance.

What will happen to Rental Yields in The Future?

See above. Much like the issue of nobody knowing exactly what a good rental yield is, nobody has a crystal ball that can tell them exactly what will happen to rental yields in the future.

Sure, a credit provider, home loan expert or real estate professional may be able to make educated guesses, but the only certainty is uncertainty, we’re afraid.

Regardless, here are a few ideas and thoughts that we’ve heard through a trusted source recently…

“Post-COVID, growth rates will moderate the most in Melbourne, Darwin, and Sydney in the coming years.”

“Capital cities, and even more so regional locations, have the potential for between 20 to 50% capital growth over the next two to three years.”

“Propertyology is forecasting dollar-value rental incomes on standard houses to rise by as much as $10,000 in the 2022 calendar year.”

“International borders opening will definitely increase rental demand as that equates to more people looking for housing.”

Things certainly seem to be looking up, so now is the perfect time to deal directly with our team of Liviti property experts when it comes to starting or expanding your investment portfolio.

We can help you find a relevant credit provider and give you solid advice regarding the rental market, home loans and more, as well as send you in the right direction towards a trusted home loan product provider’s web site.

Is My Rental Income Taxable?

In short – yes *cue boos*.

An investor will be taxed (through capital gains tax) on the amount they profit from their rental investment property.

Rental income is defined as the total amount of rent or payments received from a rented property and must be included on the investor’s tax return.

There is a silver lining, though. Often investors will be eligible to apply for exemptions, discounts or concessions which may result in a cut down portion of the payable capital gains tax (CGT) amount. CGT concessions are definitely worth looking into.

Read more about capital gains tax here.

What Are the Risks of Buying an Investment Property in High-Yield Suburbs?

There are always risks involved in purchasing investment properties.

Here are a couple that relate to buying in high-yield suburbs that may or may not affect you, depending on the research you conduct to invest wisely and the individual circumstances of the property itself…

Low capital growth

Low capital growth can be extremely detrimental to those investing in property.

Low growth means, in simple terms, that the property value is increasing at a slow rate when compared to the original purchase price.

Though the property may be experiencing high yield, overall growth can be heavily affected by supply and demand in the area with growth tending to be lower in areas with high supply and low demand.

High vacancy rates

Vacancy rates refer to the number of rental properties on the market which are unoccupied in a particular area.

When the vacancy rate is high, it provides more choices to potential tenants, at times putting pressure on rental prices for property owners.

It is often suggested that buyers invest in areas that have a wide variety when it comes to the demographic of possible renters, for example, the suburbs on the outskirts of a capital city and semi-regional areas (but not too regional).

Australian Suburbs with High Rental Yield in Recent Years

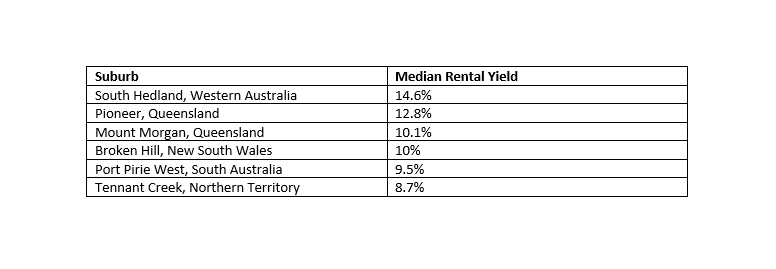

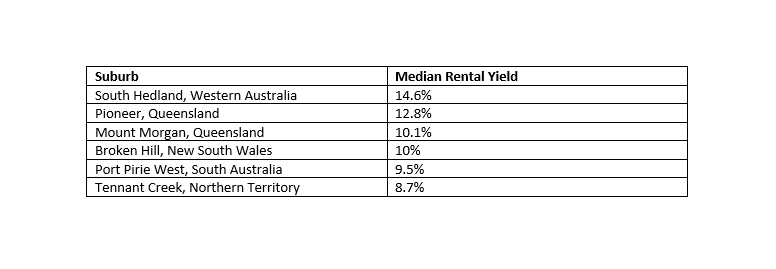

A 2020 article printed recent data released by CoreLogic, outlining the following areas as the best rental yield suburbs in Australia…

Queensland’s Gold Coast region, Broken Hill, the Northern Territory, and South Australia all make the cut, but it seems that Western Australia takes the cake in this battle to determine the highest rental yield suburbs in Oz!

It’s worth noting that, within the same study, the Central Coast region of New South Wales had quite a few areas with a relatively high rental yields that missed a mention in the table above.

Blue Haven, Charmhaven, and Watanobbi had rental yield values of 4.7%, 4.5% and 4.4% respectively, and all maintained a median weekly rent between $430 and $470.

Conclusion

All in all, our main message here is…

Don’t go pulling your hair out trying to figure out the exact numbers when it comes to the best median rental yield for an area, specific rental yield for your property or the best rental yield in general.

Do your research, deal directly with the experts and take all other relevant factors into account when it comes to property investment, rather than focusing solely on the highest rental yield stats.

If you’d like to take a look at our available properties for purchase, feel free to do so. Any questions, call our office on (02) 9056 4311 or contact us here and we’ll be happy to help.