Discover the Benefits of Different Types of Property in 2024: Off-Market, Off-Plan, and Established Homes

Ever wondered which types of property will give you the best bang for your buck in today’s real estate market?

Whether you’re eyeing hidden gems before they hit the public market, dreaming of customising a brand new home, or seeking the charm and stability of a well-established residence, understanding the unique benefits of off-market, off-plan, and established homes can unlock opportunities tailored to your needs.

Dive into our guide to discover the best type of property to invest in or purchase, and learn how each property type can align with your goals and enhance your real estate journey.

Whether you’re a seasoned investor, a first-time buyer, or someone looking to diversify your portfolio, knowing the ins and outs of different property types can significantly impact your success and satisfaction. Among the many options, off-market, off-the-plan, and established homes each offer unique advantages and considerations that can align differently with individual goals and market conditions.

Understanding these property types is not just about recognising their definitions; it’s about grasping how each can fit into your broader real estate strategy. Each type has its own set of benefits, risks, and market dynamics that can influence your investment strategy, return on investment, lifestyle choices, and overall satisfaction.

Different Types of Property in Australian Real Estate Market

Off Market Properties

Off market properties are not publicly advertised or listed on traditional real estate platforms. These properties are often sold privately, either through direct negotiations or through exclusive networks, and may include homes that are in the early stages of being sold or those that are intentionally kept out of the spotlight for various reasons. The appeal of off-market properties lies in their potential to offer unique opportunities that are not available to the general public.

Benefits of Off-Market Properties

One of the primary benefits of buying off the market property is the reduced competition. With fewer buyers aware of the listing, you may encounter less bidding wars and have a greater chance of negotiating a favourable price.

Additionally, off-market deals can sometimes result in faster transactions, as the process is often streamlined compared to traditional listings. Buyers may also gain access to properties with distinct or unique features that might not be as readily available in the general market.

Key Considerations Before Buying Off-Market Properties

When buying a property off market, it’s essential to thoroughly assess several key factors to ensure a sound investment.

Begin by determining the property’s value through a professional appraisal and comparative market analysis to gauge its fair market price. Conduct a thorough property inspection to uncover any hidden issues and review the maintenance history or have a professional inspector do this on your behalf.

Understand the seller’s motivation and urgency, as this may influence your negotiation. Additionally, perform a title search to confirm there are no legal encumbrances and carefully review all legal documents related to the property, or have a lawyer do so for you.

Consider financial implications, including financing options, additional costs, and renovation expenses. Develop a strategic negotiation plan and work with an experienced property consultant, along with legal and financial advisors, to navigate the transaction effectively.

Addressing these considerations will help you make informed decisions and manage risks in the off-market property buying process.

Potential Drawbacks

Off-market properties might not always come with comprehensive market comparisons, making it harder to assess their true value. There may also be limited information available about the property’s history and condition.

As with any real estate transaction, conducting thorough due diligence and working with experienced professionals is crucial to navigating these potential pitfalls.

Off-The-Plan Properties

An off-the-plan property is a real estate investment purchased before construction is complete, based on architectural plans and renderings rather than a finished product. Buyers often benefit from lower prices and potential customisation options, such as choosing finishes and layouts. However, this type of purchase can involve risks, including potential construction delays or changes in the development plans. It’s crucial for buyers to understand the current market to make an informed decision and manage potential risks effectively.

Benefits

By purchasing before construction is completed, buyers often enjoy lower prices and potential discounts compared to completed homes, as developers seek early commitments.

Additionally, off-the-plan property purchases can provide opportunities for customisation, allowing buyers to select finishes, layouts, and design elements to their taste. This can lead to a more personalised living space.

Moreover, investing in off-plan properties can result in significant future value appreciation, especially if the property is in a growing or emerging area.

Buyers also benefit from staged payment plans aligned with the construction timeline, making it easier to manage finances or even save more of a deposit with certain off-the-plan deposit opportunities..

Key Considerations Before Buying Off-The-Plan Properties

Before buying off the plan property, ensure the developer has a solid reputation and a track record of completing projects on time and to a high standard.

Conduct a thorough market analysis and compare the property’s projected value with similar completed properties to gauge its potential return on investment.

Additionally, review the architectural plans and specifications in detail to understand what you’re committing to, and be aware of the potential for construction delays or changes in design.

Assess the financial implications, including deposit requirements, staged payment plans, and any additional costs.

Finally, consult with legal and financial professionals to ensure that all agreements and contracts are thoroughly reviewed, your investment is protected throughout the construction process and that you will be able to afford the property upon completion.

Potential Drawbacks

Buying property off-the-plan comes with some potential drawbacks that buyers should be aware of. One is the risk of construction delays or changes in project plans, which can impact the expected completion date and the final product.

Since the property is purchased based on plans and renderings rather than a finished product, there’s also the possibility that the final construction might not fully match initial expectations.

Established Homes

Established homes are properties that have been previously owned and lived in, offering a tangible advantage of immediate occupancy and a clear understanding of the property’s condition. Buyers can inspect these homes in their current state, allowing for a more accurate assessment of value and condition. Established homes offer stability, character, and a better grasp of local market dynamics, making them a popular choice for those seeking a move-in-ready property.

Benefits

Established homes provide immediate occupancy, allowing buyers to move in without the wait associated with new construction or off-the-plan properties.

These homes come with a clear history, which can reveal important details about their condition, maintenance, and any past issues, making it easier to assess their value and make informed decisions.

Established properties often feature mature landscaping and well-developed neighbourhood amenities, contributing to a more settled and pleasant living environment.

Additionally, they are typically located in well-established communities with established infrastructure and services, which can enhance the overall quality of life.

Key Considerations Before Buying Established Homes

Before buying an established home, conduct a thorough inspection to identify any potential issues such as structural problems, outdated systems, or needed repairs. Review the property’s maintenance history to understand past renovations and ongoing upkeep.

Assess the neighbourhood’s characteristics, including local amenities, future development plans, and overall community vibe, to ensure it meets your lifestyle needs. Check for any zoning or property restrictions that could affect your use of the home.

Additionally, research the local real estate market to gauge the property’s value and compare it with similar homes in the area. Finally, consider the home’s energy efficiency and potential for upgrades to modernise the property and improve long-term value.

Potential Drawbacks

Older established homes may require significant repairs or updates to systems like plumbing or electrical which can lead to unexpected expenses.

Additionally, established homes might not offer the same level of customisation as new builds, limiting your ability to tailor the property to your preferences. The property could also come with unresolved maintenance issues or be subject to outdated designs that may not align with modern standards.

Furthermore, the neighbourhood may face challenges such as declining infrastructure or future development that could impact property values.

Choosing the Right Property Type for You

Assessing Your Needs and Goals

Begin by evaluating what you truly need and want in a property. Consider whether you are looking for immediate occupancy, the ability to customise, or a unique investment opportunity.

Reflect on your short-term and long-term goals, such as whether the property should serve as a primary residence or an investment. Understanding your specific needs and goals will guide you in selecting a property type that aligns with your aspirations.

Financial Considerations

Analyse your financial situation thoroughly before making a decision. This includes determining your budget, factoring in the purchase price, and understanding additional costs such as maintenance, repairs, or renovation expenses.

Assess your financing options and how they align with different property types. Whether you choose an off-market, off-the-plan, or established home, ensuring that your financial commitments are manageable and sustainable is crucial for a successful property purchase. For extensive financial advice, speak to one of our industry experts.

Lifestyle and Long-Term Plans

Consider how each property type fits with your lifestyle and future plans.

Off-market properties can provide unique opportunities but require careful evaluation. Off-the-plan properties come with a longer wait and potential construction risks, but offer modern new residences, capital gains through the build and early access pricing. Established homes offer immediate move-in opportunities and are often situated in well-developed neighbourhoods with mature amenities, but can come with unexpected costs in renovation and maintenance .

Reflect on how each option supports your lifestyle preferences, long-term plans, and how it fits into your overall real estate strategy.

Read More: Best Places To Find Off Market Properties In Australia 2024

Conclusion

In conclusion, choosing the right property type, whether off-market, off-the-plan, or an established home, requires a comprehensive understanding of your personal needs, financial situation, and long-term objectives.

Each property type offers distinct advantages and considerations that can significantly impact your real estate experience. By contacting our team you can gain professional insight and advice. We ensure you’ll make a confident and informed decision that aligns with your goals, leading to a smooth and successful property investment

Frequently Asked Questions (FAQ)

Q: Can I get the First Home Buyers Grant for an off the plan or off the market home?

A: Yes, you can often qualify for the First Home Buyers Grant when purchasing off the plan or off the market homes, provided you meet the specific criteria set by your state or territory. To ensure you meet all requirements and to understand any specific conditions or benefits related to these property types, consult your local housing authority or a financial advisor.

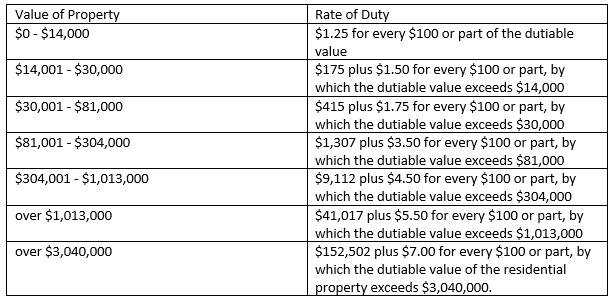

Q: Do you pay stamp duty on off the plan property?

Yes, you do pay stamp duty on off the plan properties. Stamp duty is calculated based on the property’s purchase price or the market value at the time of the contract signing, not the eventual completion price. Some jurisdictions offer stamp duty concessions or exemptions for off-the-plan purchases, especially for first-time buyers, so it’s important to check the specific rules and potential benefits applicable in your area. Consulting with a legal or financial advisor can help you understand the exact stamp duty obligations and any available savings.

Q: How can I find off the market properties?

A: Start by working with a property consultant or real estate professional, and networking with industry professionals, such as brokers and property managers who can assist you in your search. Attending local property auctions, and reviewing public records for potential leads can further enhance your search.

Q: What financial considerations should I keep in mind when buying any property type?

A: Regardless of the property type, assess your budget, including the purchase price and additional costs like maintenance, repairs, and renovation. Review financing options, consider the impact on your long-term financial stability, and consult with financial advisors at Liviti to ensure your investment is manageable.

Q: What are the typical timelines for completing off-plan properties?

A: The completion timeline for off-plan properties can vary based on the developer’s schedule, construction progress, and any potential delays. It’s crucial to review the projected completion date and stay informed about any updates or changes to avoid unexpected delays.